Sparrows SCore MPS

CIO Investment Update

For Financial Advisers and intermediaries only

Recording now available

Sparrows SCore MPS - CIO Investment Update

Watch the replay here 👇

Empower Your Advice with Evidence-Based Insight

CIO Market & Portfolios Update for Your Clients and Your Business

This session will help you:

- Understand how major geopolitical shifts, such as U.S. trade policy under Trump and increasing tensions in Middle East, are influencing markets and client portfolios

- Identify risks and areas of resilience across global markets, including equity style factors and regional rotations

- Apply insights from our evidence-based investment framework to guide clients through heightened volatility with confidence.

Meet our speakers

Raymond Backreedy, Chief Investment Officer

Raymond Backreedy, our CIO at Sparrows Capital, has over 20 years of professional experience within the financial marketplace and leads our investment team and process, combining PhD-level expertise in mathematics, statistics, and engineering with strong logical reasoning; he joined us back in 2017.

His experience spans hands-on research, development, and management of quantitative models and portfolios across both traditional passive and alternative asset classes. Raymond was a founding partner at Evolutionary Trading and Tekio Capital.

He also served as a consultant to the executive committee and board of trustees of a major Dutch pension fund, where he was involved in quantifying the impact of regulatory changes on their investment processes.

Raymond holds a PhD and MEng in Fuel and Energy Engineering from the University of Leeds.

Arnie Millington, Head of Business Development

Arnie heads up our Business Development team at Sparrows, and has a wealth of experience working with advisers, planners and wealth managers, across all parts of the industry.

He joined us in July 2024 from 7IM where he looked after advisers in the North West and Central regions. Prior to that he was at Benchmark Capital responsible for distributing the Best Practice network, Fusion platform and Schroders Investment Solutions. Arnie’s career started at AJ Bell as an Investment Analyst and he was a BDM in the South East, covering the SIPP side as well as platforms and investment solutions.

Arnie is level 4 qualified with the IMC, and is currently working towards his Investment Advice Diploma too.

Why Sparrows SCore MPS?

An intuitive and cost-effective model portfolio range for Financial Advisers. Designed to enhance your client value proposition.

About Sparrows SCore MPS?

We are an independent Discretionary Fund Manager (DFM) offering a low cost, capped-fee evidence-based MPS to advisers. Our evidence-based portfolios are designed to deliver market returns consistently and efficiently.

We are dedicated to delivering a clear, transparent, and predictable evidence-based investment process, grounded in robust academic research and over 100 years of market data.

Our SCore MPS offers the high-quality investment process used by some of the world’s largest investors, delivering exceptional value to advisers and their clients at a time when cost scrutiny in the industry is increasing.

Product and pricing innovation

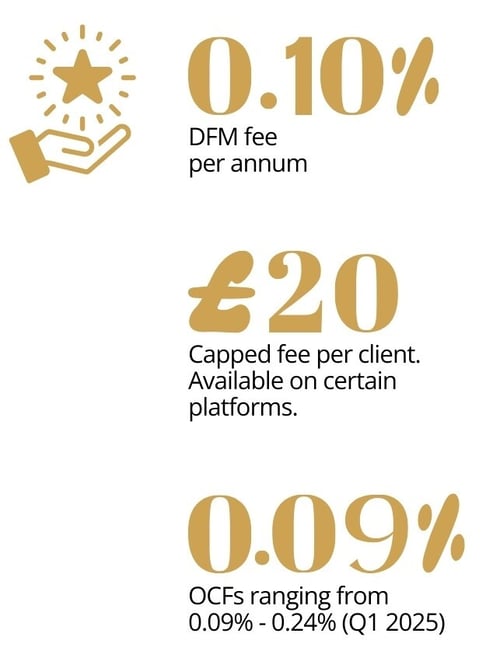

Unique pricing model: 0.10% per annum, capped at £20 per underlying client per month (available on certain platforms), with OCF’s starting from as little as 0.09%.

We are an independent DFM offering a low cost, capped-fee evidence-based MPS to advisers. Our evidence-based portfolios are designed to deliver market returns consistently and efficiently.

Breakthrough benefits

A fully independent offering, we begin with the whole of market universe, selecting best-in-class investment vehicles from multiple providers to support advisers’ client strategies.

- Adviser-only, platform-based MPS using low-risk, liquid Index Funds and ETFs

- Pioneers of Evidence-Based Investing

- Ranges: Market, Factor (with tilts), and Responsible (with ESG/SRI filters)

- Portfolios spanning the full risk spectrum (0% to 100% equity)

- Selective currency hedging and inflation protection

- Index fund only or index fund and ETF versions

- Available on multiple platforms

- Factor and Responsible ranges risk-rated by Defaqto for adviser mapping

- Capped pricing structure, available on certain platforms, and evidence-based approach provide clear value.

More on our SCore MPS

At Sparrows Capital, our Managed Portfolio Service (MPS) – Sparrows SCore MPS – is built on evidence-based investing principles, offering a diversified, cost-effective, and disciplined approach, designed to help your clients’ investments flourish over the long-term.

Discover how our strategies can support you in delivering consistent, research-backed investment solutions for your clients.

Have a question?

If you have any questions after watching the recording — or would like to learn more about how we can support you — our team is here to help.

Just get in touch.